Assess your cost recovery potential

Use this play to...

- Review current cost recovery policies for services offered and revenue generated through the use of regulatory fees, non-statutory contractual arrangements, and revenue agreements.

- Design and implement new cost recovery approaches.

- Modernizing cost recoverable services.

Running the play

The success of Canada’s transportation sector is very much dependent on TC services such as inspections and authorizations (including licences and certificates) for individuals and companies, enabling Canadian transportation industries to operate safely and efficiently.

Modernizing TC’s service fees and fee structures is critical in order to respond to the evolving transportation landscape. The Department’s cost recovery framework must consider the growing operating costs in an increasingly complex, technologically-advanced and internationally-integrated transportation sector in order to provide efficient and predictable services across all sectors.

Guiding principles

The guiding principles for the implementation of cost recovery are:

- Efficiency

- Equity

- Consistency

- Sustainability

- Transparency

In order to reach these values, follow the following checklist:

Efficiency

- Administrative burden for service recipients should be reduced, where possible.

- Services should be delivered to service recipients in an efficient and modernized manner.

- Transaction costs in setting, collecting and administering service fees should be minimized.

Equity

- Fees should have a direct relationship to the cost of providing the service.

- Fees should be implemented commensurate with what the market can bear, taking into account diverse industry sectors and service recipients financial capacity to pay.

- A whole-of-government approach should be applied when assessing impact to the economic sector.

- The recipients who benefit directly from TC services, rather than the general public, should bear the majority of the costs.

Consistency

- New or amended fees, contracts, and revenue agreements should be applied consistently across services and sectors where feasible and to the maximum extent possible.

- Fees between and within modes should be applied as consistently as possible with regards to similar or the same services.

Sustainability

- TC’s capacity and ability to deliver its mandate in a timely manner should be enhanced.

- Fees should be easily adaptable to changes in the operating environment, and easy to update.

- Consideration should be given to the materiality of the fee; in terms of the benefit derived versus the cost of administering the fee.

Transparency

- Stakeholders should be consulted and engaged when establishing/changing service fees.

- Greater transparency should be established through service standards for services/activities delivered by TC.

- The service standards related to the service fee should be clear and meaningful to service recipients.

Tip

The Cost Recovery Assessment Questionnaire (accessible only on the Transport Canada network) has been developed by the Cost Recovery Team to identify proposals, projects and initiatives with a potential to charge external stakeholders to recover some of the costs.

Completing the questionnaire early in the development of a proposal may identify significant cost recovery potential.

Cost Recoverable Activities

The primary criteria used by TC to assess eligibility for cost recovery is the degree to which an activity provides direct benefits to specific private individuals or entities beyond those benefits enjoyed by the general public.

Direct Benefits

Direct benefits are exhibited in many forms. An individual licence holder directly benefits from holding a licence as it provides the individual with regulated access to commercial markets, labour markets, and/or leisure opportunities. Private entities realize direct benefits via TC regulatory activities in the form of: reduced risks and liabilities; improved market access for their products and services; enhanced credibility; and enhanced public confidence in their industries.

Statutory Basis for Cost Recovery Activities

Cost recoverable activities are typically (although not always) activities that have a statutory basis – in other words, activities related to services, programs, etc., that are set out in legislation or regulations. Ideally, in addition to the cost recoverable activity being established by statute or regulation, the authority to cost recover for those activities should also be explicitly referenced in law – put another way, the enabling statute should provide the Governor in Council or the Minister the authority to make regulations setting fees for particular activities.

When a Statutory Basis for Cost Recovery Activities Does Not Exist

The introduction of a cost recovery regime for statutory activities that lack the authority to recover costs first requires Cabinet approval, generally though a Memorandum to Cabinet. Such approval would entail authorization to either establish a cost recovery regime under the FAA or under the specific legislation governing the program or activity. Where a legislative amendment is required, business lines should consult with the Parliamentary Affairs and Departmental Regulatory Affairs and follow the process outlined in the Privy Council Office’s Guide to Making Federal Acts and Regulations.

The Minister also has the capacity to enter into a contract for the provision of activities or services that currently do not have a statutory basis (i.e. non-statutory contract). Consultation with the Corporate Cost Recovery Team and Departmental Legal Services should be undertaken when considering this type of cost recovery arrangement.

Tip

Generally, a cost recoverable activity falls into one of the following categories:

- The provision of a service;

- The provision of the use of a facility;

- The conferral, by means of a licence, permit or other authorization, of a right or privilege;

- The provision of a product; or

- Non-statutory contract.

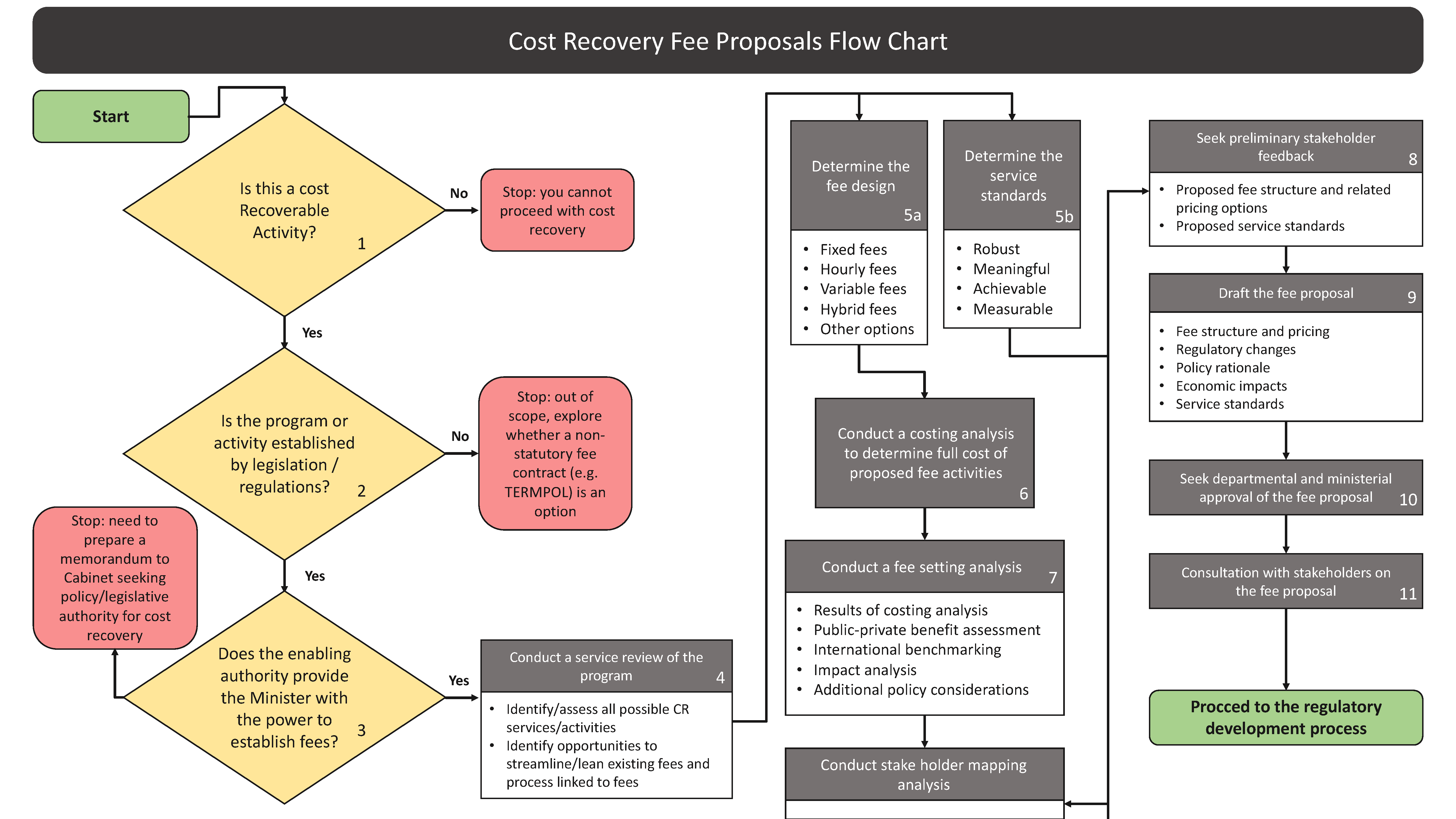

Cost recovery process

The vast majority of TC fees are set out in regulation. The process flow chart below depicts the general Cost Recovery process for fees set by regulation.

Cost Recovery Fee Design

TC will strive to implement consistent fee design for similar activities in different modes. Fee design begins with the determination of the appropriate fee type for the activity being delivered.

The following are fee types that are applicable to services provided by TC:

- Flat Fee

- Hourly Fee

- Hourly with Fee Cap

- Hybrid (Flat Fee and Hourly)

- Per Unit of Measure

- Differentiated Pricing

Consult the Transport Canada Cost Recovery Implementation Framework (accessible only on the Transport Canada network) for details on fee types.

Service Standards

Senior departmental managers are responsible for the establishment and communication of service standards for all new and existing fees.

The following principles should be applied when establishing or amending service standards:

- Available for Each Fee

- Comparable

- Meaningful

- Measurable

- Based on Consultation

- Attainable and Challenging

- Affordable (both for the paying service recipient and the Department)

- Endorsed by Management

- Communicated

- Published

- Reported

- Continuously Updated and Managed

Tip

A service standard is a commitment to a level of performance that tells service recipients what to expect in terms of speed of service delivery, how services will be delivered and what they can do when they are not satisfied with the standard of service they receive. Service standards are integral to good client service and to effectively managing performance. Consult the TBS Guideline on Service Standards for more information.

Costing for Fee Modernization

A high quality and reliable cost estimate is the output of a process that includes multiple steps, a systematic and repeatable process for all cost estimates developed by TC’s Cost Recovery unit, and aligned to the generic costing approach described in the TBS Guide to Cost Estimating.

|

Step |

Description |

| 1. Cost Estimate Planning |

|

| 2. Cost Breakdown Structure / Establishing the Cost Base |

|

| 3. Data Collection and Analysis |

|

| 4. Ground Rules and Assumptions |

|

| 5. Cost Modelling / Methodology |

|

| 6. Uncertainty and Risk Analysis |

|

| 7. Validation |

|

| 8. Reporting & Approval |

|

Fee Setting Analysis

Every pricing exercise should be approached and undertaken with due diligence, keeping in mind that departmental fee setting efforts should reflect the materiality of a given fee and/or the expected reaction it may garner from stakeholders.

When determining an appropriate fee amount for a particular service or activity, a number of factors must be taken into account, including:

- Results of the public-private benefit assessment;

- Results of the international benchmarking;

- Results of the impact analysis / economic impact assessment;

- Analysis of additional policy considerations; and,

- Stakeholder consultation.

Tip

Section 12, Fee Setting Analysis, of the Transport Canada Cost Recovery Implementation Framework (accessible only on the Transport Canada network) provides comprehensive details about the factors used to set fees.

Development of a Fee Proposal

Fee proposals are developed and used during engagement with stakeholders. They are used to discuss the introduction of new fees or the modification of existing fees, prior to formal consultation as part of the regulatory process. By doing extensive engagement, the regulatory process is accelerated and comments received by the stakeholders during that process are limited.

Each Fee Proposal must include the following:

- Description of the service for which the fee is proposed and the circumstances in which the fee will be payable;

- Policy rationale for the fee;

- Costing analysis;

- Amount of the fee or the manner for determining its amount;

- Factors taken into account in determining the amount of the fee or the manner for determining its amount, including:

- Results of the public versus private benefit assessment;

- Results of the international benchmarking analysis;

- Results of the impact assessment or Economic Impact Assessment (where applicable);

- Additional policy considerations; and

- Stakeholder consultation.

- Estimate of the amount of annual revenue the Department will receive from the fee; and,

- Service standards that will apply in respect of the fee.

Tip

Consultation with the Corporate Cost Recovery Team is required before proceeding with a Fee Proposal. The TC Fee Proposal Template is the basis of all fee proposals for the Department. You will find the template at Annex A of the Transport Canada Cost Recovery Framework (accessible only on the Transport Canada network).

Consultation and Engagement Strategy

Best practice is to engage as early as possible in the decision-making process and throughout. Engagement can be undertaken in a number of different formats, depending on the level and interest of stakeholders and other strategic considerations associated with individual business lines. The duration, scope and intensity of engagement may vary by business line, depending on the nature of the fee, the type of impacted stakeholder, and other considerations such as linkages to other initiatives.

Consult the Cost Recovery Engagement Framework (accessible only on the Transport Canada network) or the play [Communicate and engage with your stakeholders] for more tips and best practices.

Other resources on this topic

- A reference guide to transform policy into Federal Acts and regulations outlining the roles of the participants in this process: Guide to Making Federal Acts and Regulations, 2nd Edition (Privy Council Office, 2001)

- Advice and tools for managers and functional specialists regarding regulatory consultation in the context of the Cabinet Directive on Streamlining Regulation: Guidelines for Effective Regulatory Consultations (Treasury Board Secretariat, 2007) (PDF, 196 KB)

Terms of use

Materials on this website were produced and/or compiled for the purpose of providing Canadians with access to information about the programs and services offered by the Government of Canada. It is subject to the following Terms and conditions.

- Date modified: